Microfinance Industry and Public Sector Banks: Unutilised Liaison

- Industrial Outlook

Dr. Saibal Paul

- August 1, 2020

- 3

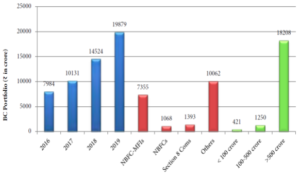

Microfinance is a much recognized array of financial inclusion. As per data of Equifax, in February 2020, loan accounts, excluding banks & SFBs, stood at 482.35 lakhs however loan accounts, including banks and SFBs, was 1,020.45 lakhs; there were 552.33 lakhs unique clients. Portfolio stood at ₹ 93,799 crores, without banks & SFBs and ₹ 2,23690 cr with banks & SFBs. Average loan per customer was ₹ 36,336, including banks and ₹ 31,139 excluding banks. The efficiency of microfinance is definitely not in the quantum of the money but the beneficiaries of the sector, poor and financially marginalised whom formal banking system has not bothered to embrace.

It is partly for apathy and partly for small tickets size. The irony is, those whom been ostracised by mainstream banking are better customers by means of repayment. Banks had gross NPAs at 9.1% in FY19 whereas Portfolio at Risk of MFIs are far below than the banking industry, 0.65%, presumably the NPA will be much lesser. It is probably the only model in the space of financial inclusion where unsecured loans are having almost hundred percent repayment.

As visible from the repayment, the investment in the sector is also secured. MFIs have furthered the cause of taking financial products to the last person passing through operational and structural challenges. Each time the sector faced challenges, it emerged as a stronger self. The Industry is working in the midst of policy gaps and dealing with poor people who are also soft target for decision makers However, with support of the regulator, the industry made a mark in the financial inclusion of our country. CRISIL Inclusix 2015, has scored Financial Inclusion of India with 50.1 points and the growth was attributed to the presence and penetration of Microfinance Institutions. The sector could have been utilised by government in a more efficient way.

The major challenge this industry had faced was in 2010, in Andhra Pradesh. By acknowledging excesses made by the MFIs, it may be noted that there was no policy framework for the sector. There was no strong Credit Information Bureau to resonate the improper assessment of the clients leading to over lending; lesser awareness the clients constrained them to access loans from possible alternate sources to manage future uncertainty.

The next challenge industry had faced was during demonetization. The clients did not have liquidity to repay and as there was no exhaustive policy for microfinance industry. The local level power holders with vested interest encashed the opportunity. They occluded the repayment by misguiding beneficiaries by posing the repayment deferment as high probability of loan waiver. But in both of the cases, industry reverted with sustained substantial growth.

Unlike microfinance industries of other countries, major lenders for microfinance sector are Indian banks, both public sector and private sector. However recently either banks are starting their own operations, or trying to take over the established MFIs and or pursuing for BC model.

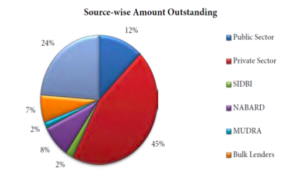

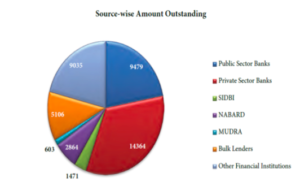

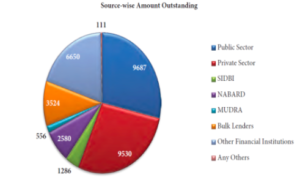

Borrowings by MFIs in FY 18-19, from private sector bank was 45% and public sector banks was 12 %, in FY 17-18, from private sector banks was 33% and public sector banks was 22 %, in FY 16-17, from private sector bank was 28% and public sector was 29% of the total yearly borrowings. As evident from the pie charts mentioned above, public sector banks are shying away from investment in the microfinance industry despite of assured returns. As public sector banks are supposed to be doing more public good and can take risk, the reduction of their lending limiting the scope to development of the new products in the microfinance sector. It is evident also in the products of microfinance, the microcredit is invested in different segments, e.g. agriculture, trading, micro enterprise and others with same financial product, there is no difference in the repayment structure.

There is other trend in the market, adopting Business Correspondence route, merger and acquisitions. Microfinance industry is observing, merger of Bharat Financial Inclusion (BFI),

Microfinance Is a leading Business Correspondent to Kotak Mahindra Bank Ltd and others also, for example, Grama Vidiyal Microfinance Limited is now wholly owned subsidiary company of IDFC Bank Ltd. As per BMR 19 there are four MFIs exclusively working as BC and many are coming up. State Bank of India also is likely to roil the microfinance segment as because they are planning to offer micro loans at lower rate through its wide network of branches.

Microfinance is much more than exclusively banking or financial intermediation. It is taking dignified and apt financial products to the poor people at their door step at their decided time. Many studies as well as repayment shows that the rate of interest does not make much difference. Eventually with the proper regulation and competition the rate of interest softened. In India the rate of interest to the end client ranges from approximately 18% to 24% depending on the cost of fund (sometime its as high as 16%) however there is a strict stipulation of RBI. Eventually violation of the norms will reduce the rating of the MFIs as well.

Though there may be substantial gaps, still Indian microfinance market is very much regulated and well managed. Microfinance came into being primarily because of non-reaching of the formal financial institutions and also severe mismatch of the financial products. Over the period, MFIs are unquestionably reaching to the financially unreached people but with a very standard loan product. As mostly MFIs depend on the lenders, so lenders’ comfort in the proposed product acts as supreme.

Making microfinance industry a subset to banking industry may prove an obstacle to their spontaneity. This is because the flexibility which could be adopted by MFIs on decision making and implementing of the project for prototype development, is absent in formal banking system. Instead of making the MFIs Business Correspondent, public sector banks could have leveraged equities to the MFIs and on that basis, the MFIs could raise external commercial borrowings and make the industry stronger and self-sustainable. (Source : Annual industry analytics of overall microfinance sector widely used by regulators and ministries, published by Sa-Dhan.)

Dr. Saibal Paul

Associate Director of Sa-Dhan.

3 Comments

It’s a wonderful article with plenty of information.

Informative.thanks for sharing

It is true that that the only development intervention which brought last mile connectivity at a sustainable way is microfiber.Ofcourse it did with exploitative rates.Indian industry travelled the the road from subsidised rates to sustainable rates when financial inclusion was a committment.Now it is corporatised money lenders enriching promoters.i would oague other wise that banks should stop lending to MFI and insisit on BC model.Why should our tax money should promote the interest of promoters.The article packs any logic