Can post pandemic Chinese data dodge global recession?

- Industrial Outlook

Suneel Sharma

- September 25, 2020

- 0

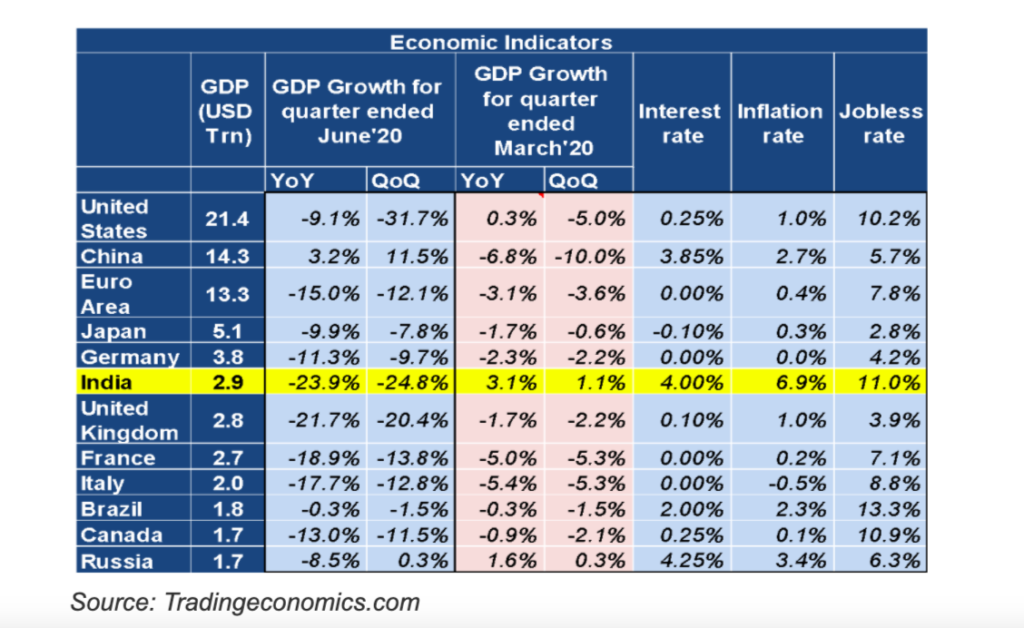

Even as most of the major economies of the world have witnessed deep contraction during the quarter ended June’2020, Chinese economy grew by 3.2 % yoy, rebounding from a 6.8 % yoy contraction in the previous quarter. On qoq basis Chinese economy registered 11.5% growth. The contrast is surprising and creates doubt on integrity of data.

Indian Economy

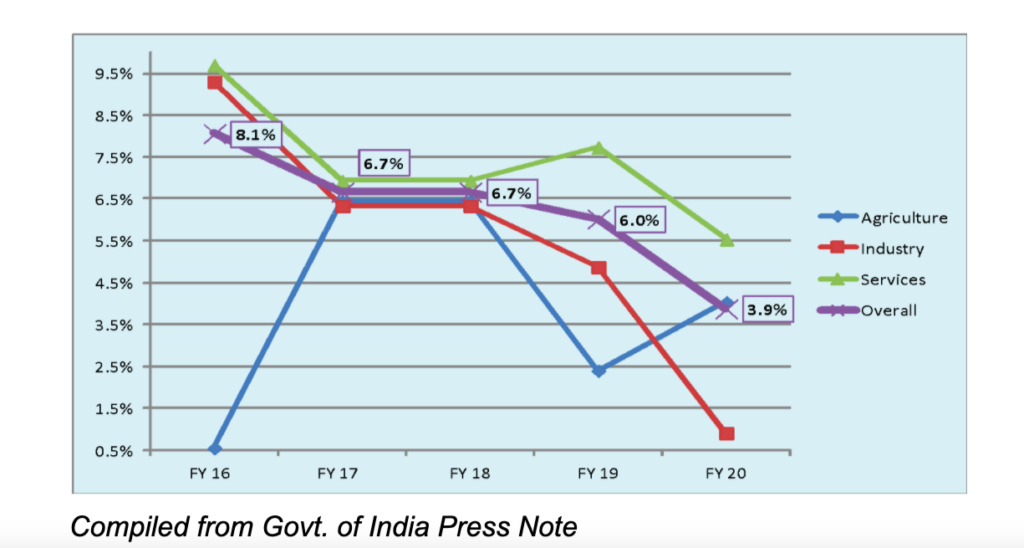

GVA Growth at Basic & Constant Prices (2011-12)

From the chart given above it is apparent that the Indian Economy is in a secular trend of slow-down with a steep fall in Industrial growth. Despite increased spending by Government, growth of Services Sectors has also declined. Agriculture has shown an uptick but the weight of the sector is quite low to support the overall growth. , under present circumstances growth slowdown has taken a backseat and the greatest concern is recovery from deep contraction caused the Pendemic.

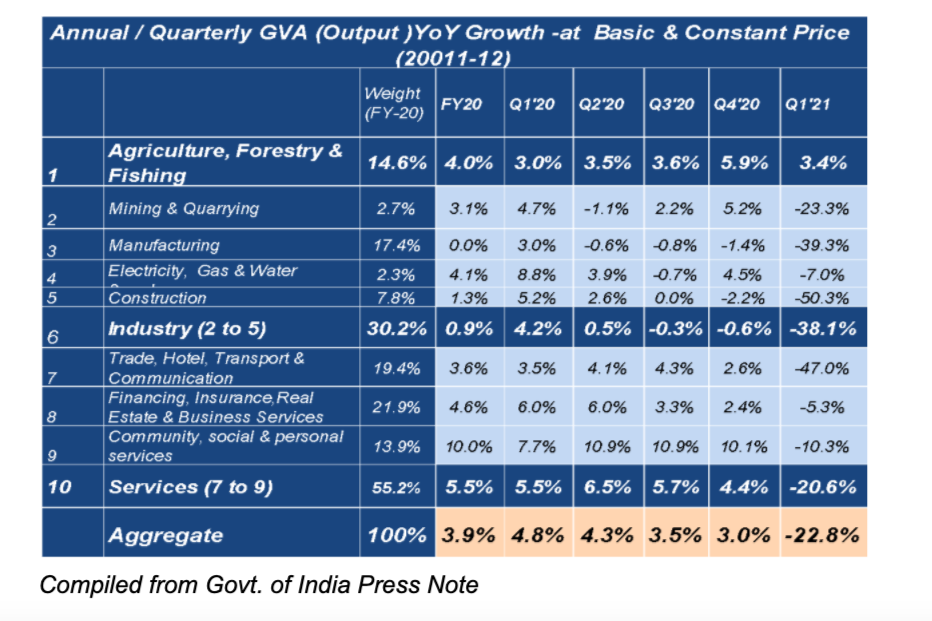

The economy being under a strict lockdown, sharp contraction of GVA growth by 22.8% (GDP -23.9 %) for the quarter ended June’20 is no surprise.

Manufacturing, Construction, Trade /Hotel/Transport/ Communication were the worst hit segments. Going forward, with return of migrant labor and on the back of pent-up demand Manufacturing and Construction sectors may look-up, while Hotel and Transport segments are still continuing under considerable restrictions.

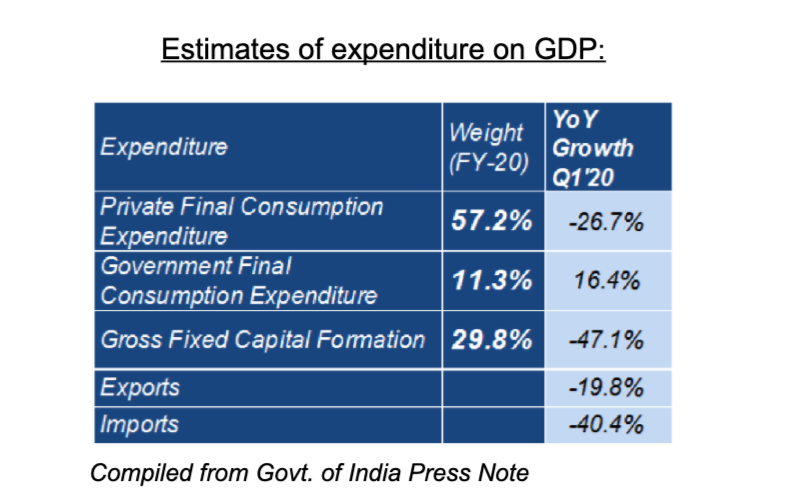

- With limited physical mobility, discretionary spending took a hit as a result of which Private Final Consumption Expenditure – PFCE (weight: 57% in FY 20) contracted by 27%. The situation may also have been impacted as incomes fell. Government Final Consumption Expenditure – GFCE that increased by 16% did not help much due to low weight (11.3% in FY 20) to the overall GDP.

- Gross Fixed Capital Formation (weight: 29.75% in FY 20) contracted by 47%. With migrant workers returning back, activity in infrastructure and other projects appears to be gearing up. Thus going forward contraction in GFCF (Investment) may recede.

- In the past few years, government has increased expenditure. In the quarter ended June’20 it registered 16% yoy growth and gained weight at around 18% of the GDP in QE June’20 (as against 11.8% in QE June’19), the highest in the last about 20 years.

- Additional Government expenditure ensured lower contraction of the economy, excluding which the economy contracted by about 30%

- Being the major contributors to the GDP, the key to revival of the economy lies with healthy and sustained growth of PFCE and GFCF (Investments).

Silver Lining..

For Indian economy imports are usually more than exports and Net Exports (Export- Imports) is generally a negative value which pulls down overall GDP. Q1’21 was an exception as Exports contracted by 19.8%, while imports contracted by 40.4% and the Net Exports were positive which pushed-up the overall GDP. Sharper contraction in imports was due to fall in oil prices and slump in demand of imported products. Huge savings in forex outflow has contributed to a record high forex reserves at USD 535 billion as on 31st July’20. Besides lower Trade Deficit, increase in reserves is also contributed by surge in Gold Prices and increased FDI/FPI inflows. The rising forex reserves have come as a breather for the economy as it can cover India’s import bill of more than one year.

As on 28th August’20 forex reserves increased further to USD 541 billion.

Going Forward..

Manufacturing Activity Picking Up

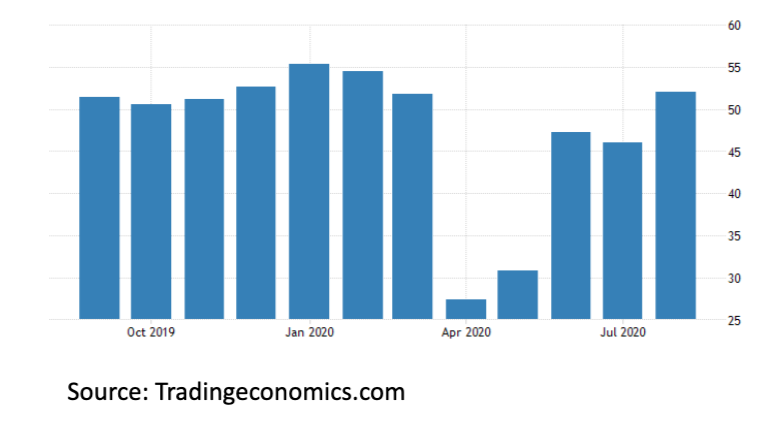

- Manufacturing PMI increased to 52 in August ‘20 from 46 in the previous month, beating market consensus of 48.2.

The latest reading pointed to the first monthly expansion in factory activity since March, led by an improvement in customer demand. Output and new orders expanded at the fastest pace since February, while the job shedding continued for a fifth consecutive month.

Services Sector still in Contraction mode

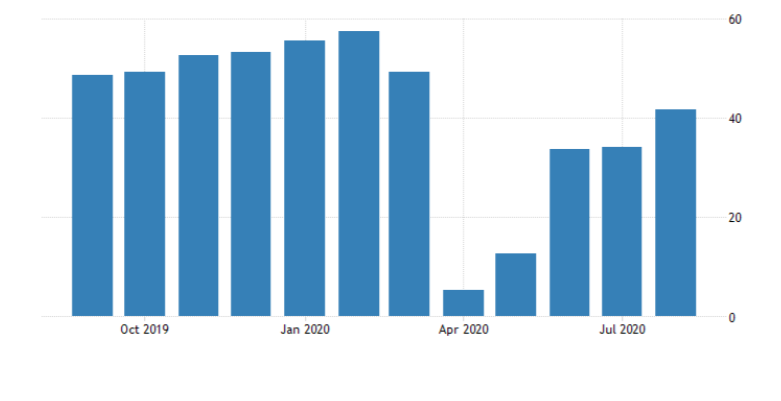

- Services PMI rose to 41.8 in August 2020 from 34.2 in the previous month, beating market consensus of 39.2. This was the highest reading since March, but it was still below the neutral level, signaling a fifth consecutive decline in private sector business activity.

Source: Tradingeconomics.com

Trade Balance

In July ‘2020 exports declined 10.2 %, slightly lower than 12.4 % in June’2020 as trade of major foreign-exchange earners such as petroleum, gems, electronics, and textiles remained subdued. In July, exports were stabilized by large shipments of engineering goods and pharmaceuticals being cleared over the month. Engineering goods exports rose 8 per cent to $6.6 billion, following a 7.5 per cent fall in the previous month

In July ‘2020 imports plunged 28.4 % and trade balance stood at USD 4.83 billion against 1343 billion in July 2019 and surplus of USD 0.79 billion in June’2020.

Agriculture

The government’s spend on agriculture has risen substantially of late and healthy and well-spread monsoon raises hope. Sowing is progressing well at about 10 % higher yoy and over 95 % of total kharif acreage had been covered. Increase in rural income can spur demand and is likely to benefit agriculture-related industries. This raises hope that agriculture can help Indian economy from sinking too low this fiscal year.

Financial Results of Corporate

For Q1FY21,due to sharp fall in economic activity net sales of listed Companies went down by over 25% yoy and profitability contracted by over 50 % yoy. The numbers are, however, far worse for manufacturers, who bore the brunt of the lockdown.

Faster than expected business recovery from the Covid-19 shock revived investor sentiment in the stock market.

Mr. Suneel sharma

Chartered Engineer/Project Appraisal Specialist/promoter: Dsat Techno Economic Solutions