Is Global Economy Recovering?

- Industrial Outlook

Suneel Sharma

- August 1, 2020

- 0

The UN’s mid-year report, published in May’2020, forecasts world economy to shrink by 3.20% in the year 2020, the sharpest since the great depression of 1930s. Although new infections and the death rates have recently slowed, the pandemic’s future course remains uncertain, as does the economic and social consequences that will follow.

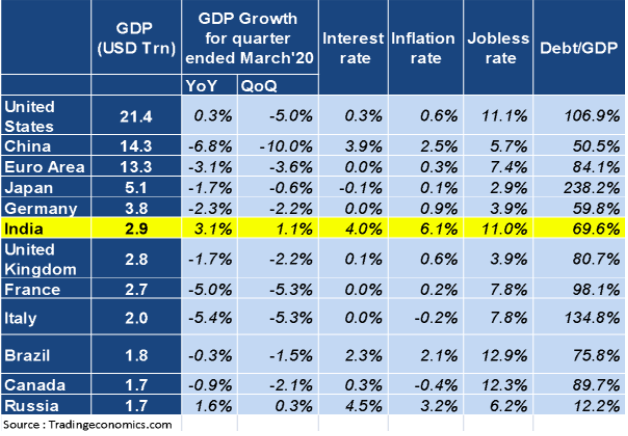

Select Financial Indicators of Major Economies

Torn between saving lives and reviving the economy, some Governments cautiously eased the restriction in the quarter ended June’20 to jumpstart their economies. While data of most of the economies is yet to be announced, recently published data from China is quite encouraging with QoQ growth at 11.5%, indicating recovery of the contraction of the previous quarter entirely. Release of quarterly numbers from other countries, will bring about clarity on the trajectory of the global economy.

In a sharp contrast to the increasing sovereign debt, interest rates are turning benign as monetary policies are being eased and fresh liquidity being injected. A large part of such easy money is chasing equity markets, which have risen beyond their intrinsic values. Market participants have come to the terms that FYs 21 & 22 will be wash outs and that the level the economy at exit of FY22 will be approximately of the same size as it was in FY20.

New Cold War:

Bilateral trade relationships between China and USA were already all time low due to perception in US that after years of targeting industries, China is, now in a big way, stealing Intellectual Properties to develop it’s technologies at the expense of USA and also building up its military power, with huge defense budget, to catch up with the military prowess of US. While a new Cold War was already brewing, mistrust caused by the spread of Covid-19 has precipitated geopolitical conflicts.

However, aggravation tensions and consequent disruption of global supply chains from China would delay and complicate Global economic recovery.

Domestic Economy:

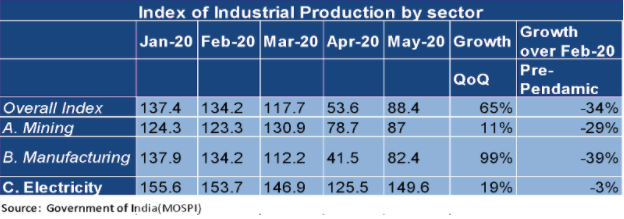

Index of Industrial Production has shown improvement during May’20 over the previous month, but the index and all its components are much below the Pre-Pandemic levels.

Economy in Contraction Mode Still, but Signs of Recovery Visible:

Both Manufacturing and Services PMI for June’ 20, are continuing in contraction mode (below the neutral mark of 50) but have improved significantly, well above the market estimates, showing green shoots of recovery.

- Manufacturing PMI in June’ 20 increased to 47.2 from 30.8 in May’ 20, beating the market consensus of 37.5.

- Services sector PMI increased to 33.7 in June’20 compared to 12.6 in May’20, which is above the market consensus of 22.3.

During June’20, exports declined by 12.41 % yoy. But if seen in the context of a whopping decline of 60 % in April’ 20 and 35% in May’ 20, indicate revival.

Improvement in unemployment rate to 7.94% on 19th July’20 from peak of over 27.1% on 5th May’20 also indicate revival of economic activities, though the revival is slow, punctuated with intermittent lockdowns, in the wake of increasing infections.

The southwest monsoon has made a good start across India, though with some shortfall in the Northern States. The steady monsoon progress has spurred sowing of kharif crops, which is about 21% more over the previous year level in the same period and water level in reservoirs has also improved satisfactorily. Good progress of Monsoon is expected to have positive impact on the rural economy.

As per a recent HSBC survey, 73% of firms say that they are agile enough to deal with the impact of the pandemic

GDP Predictions Post Announcement of Economic Package by Govt. of India

As per a recent CRISIL research, GDP of India is expected to contract by 5 per. This will have hard impact on MSMEs. Micro units are expected to have harder hit than their small and medium peers. Revenues of MSMEs are estimated to contract by 17-20% and EBITDA margin may dip to 4-5% from about 7% at present.

Government of India is Proactive

To help MSME segment, contributing over 25 % of the GDP of the country, a Rs3.00 lakh crore collateral free lending facility announced by the Government can infuse significant liquidity in this segment and will help about 45 lakh units. However, major part of the credit will be available to the small and medium units and a large no of micro units are estimated to be left out due to change in definition of MSME segment.

Duty protection Schemes and other measures announced by the Government may also be supportive in arresting the negative impact of the Pandemic.

As a part of long-term strategy, Indian missions the world over are being harnessed in the cause of channeling a coordinated push for exports and back home initiatives for import substitution through domestic production are being initiated.

In an effort of further the cause of self sufficiency and national security, Government has imposed restrictions on public procurement from China and other countries with common border.

Balance of Trade

The country posted a trade surplus of $ 0.79 against trade deficit of $3.15 billion in May’ 20 as import fell sharply by 47.59 % yoy, with the biggest decreases reported in gold (-77.42 %), coal, coke & briquettes (-55.72 %), petroleum, crude & products (-55.29 %).

Inflation under Control

- Wholesale Price Index (WPI) continues in deflate for the last 3 months. For the month of June’20, YoY inflation based on WPI stood at -1.81% (provisional). The same for the months of May’20 and April’20 was -3.21% and -1.57% respectively.

- Consumer Price Inflation for June 2020 at 6.1% vs. 3.2% a year ago. Due to lockdown adequate data samples during April’20 and May’20 could not be collected and the data for June’ 20 is also not quite robust.

A Perception on Sectoral Performance of the Businesses

Negatively impacted

- Aviation, Hotels, Restaurants, Food Chains, CVs, Passenger Cars, Two Wheelers, Consumer Non- durables, Industrials, Capital Goods infra space etc.

- Sectors that are actively engaged in trade with China such as Parts of mobile phones, Integrated circuits, Solar panels, Lithium batteries, Laptops, Antibiotics, Urea, DAP, Iron and Steel Products, Auto Parts,P-xylene, Light Oils, Polyethylene, Cotton, Iron Ore pallets etc.

Better performers

- Agriculture, Financials (including NBFCs), Pharma, FMCG, IT services, and Specialty Chemicals.

- With a positive outlook on rural economy performance of the sectors with Agri-inputs, tractors, two wheelers and consumer durables is expected to improve.

- With expected government support performance of industrials and infrastructure sectors may improve, going forward.

A Message:

This will also pass away and forgotten and the difficult circumstances offer opportunity as well.

A pessimist sees difficulty in every opportunity and optimist sees opportunity in every difficulty.(Winston Churchill)

Mr. Suneel sharma

Chartered Engineer/Project Appraisal Specialist/promoter :Dsat Techno Economic Solutions